- Indian equities have been a strong outperformer in the broader EM in the recent years, with all sectors performed positively.

- Recently, Indian equity valuation has come down after market correction, partly because of profit taking, geopolitical dynamics in the Middle East, and the upcoming US presidential election.

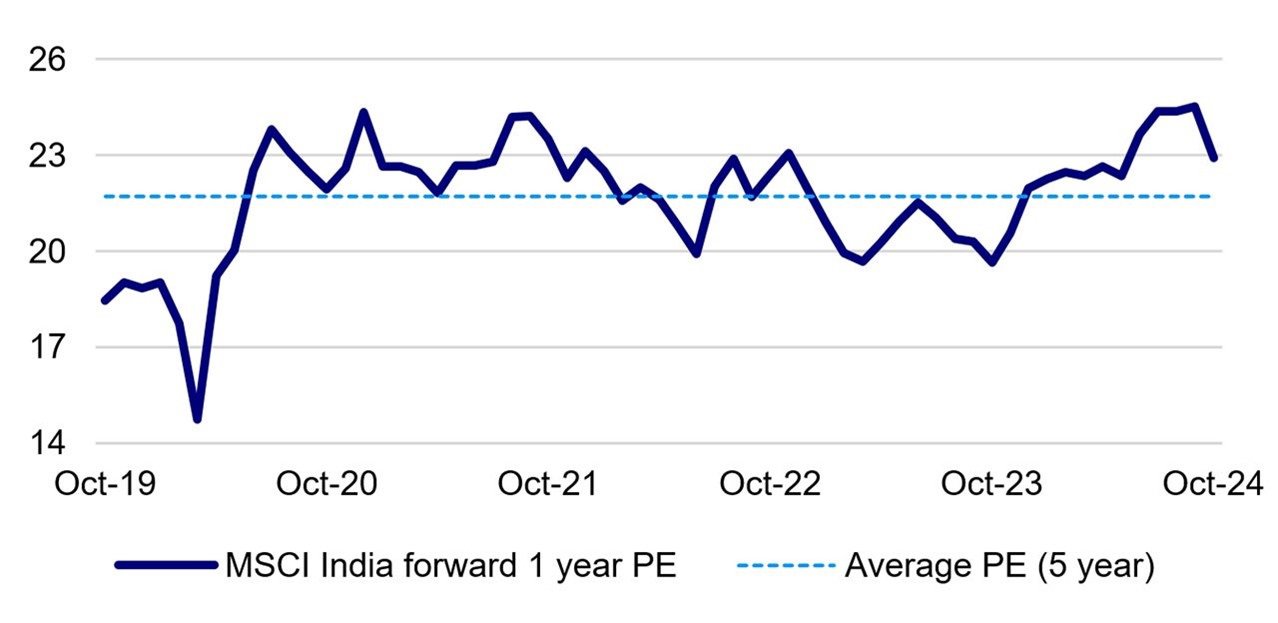

- From a valuation perspective, Indian equities (as represented by MSCI India) are currently trading below 1 standard deviation level of the past 5 years.1

- Selected mid-cap stocks with strong fundamentals and better earnings visibility have also experienced corrections, resulting in more reasonable valuations compared to a few weeks ago.

(Source: FactSet, 25 Oct 2024.)Given the long-term growth drivers remain intact, we expect valuation of Indian equities to remain within the range of the longer-term trend.Robust earnings growth

(Source: FactSet, 25 Oct 2024.)Given the long-term growth drivers remain intact, we expect valuation of Indian equities to remain within the range of the longer-term trend.Robust earnings growth- The EPS growth of Indian companies is strong, and notably better than that of most developed economies and selected emerging markets such as Thailand, Indonesia, Brazil.

- Market consensus for MSCI India forecasts earnings growth of 15% to 16% in 2024 and 2025 respectively2, with mid-teen profit growth expected to be sustained in the coming years.

- Currently it is the earnings season of the India market and so far as we see, the latest earnings announcements remain solid.

- The Return on Equity (RoE) of MSCI India reached a 13-year high of 16.9% in FY 2024, indicating improved returns for investors.3

- Indian companies are projected to achieve higher and more sustainable RoE going forward, having transitioned from low to mid-teens RoE in recent years.

- Over the past decade, Indian companies have effectively managed their balance sheets, maintaining under-leveraged positions that support participation in demand-driven growth.

- The debt ratio for MSCI India is much better, as represented by total debt divided by total assets, has decreased from 28% in 2019 to 21.2% by Q3 2024.4

- Free cash flow relative to sales has also risen sharply and is currently above the long-term average. We anticipate that corporate balance sheets will continue to strengthen.

- Liquidity remains strong in the Indian equity market, supported by robust domestic liquidity in addition to foreign institutional flows.

- This trend reflects the high confidence that the Indian public has in their economy and the market, with these positive structural flows expected to persist.

- Indian equity valuation is getting back to a more comfortable level.

- As investors, we believe the key will always be bottom-up stock selection.

- There are always companies & hidden gems with upside potential; however, it's crucial to maintain a disciplined valuation strategy.

- Recognizing the strong fundamentals and macro stability that support India's equity valuations suggests further upside potential.

- We believe a disciplined investment process is essential for valuation assessment.

- We carefully assign fair values that reflect the intrinsic worth of our investments when it comes to portfolio construction. This approach ensures we do not overpay while effectively capturing the upside potential in the opportunities we pursue, allowing us to adjust our positions as needed.

- Our constructive positive view on Indian equities is supported by consistent policy continuity, macroeconomic resilience, supportive domestic flows and strong economic growth leading to mid-teen earnings growth.

- We believe that current valuations make Indian equities more interesting for investors seeking opportunities in the Indian market.

- Factset, 25 October, 2024

- Goldman Sachs, 25 October 2024

- Morgan Stanley, 24 October 2024

- Bloomberg, September 2024

Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.