Invesco’s Commentary: 2024 Mid-Year Investment Outlook – China equities

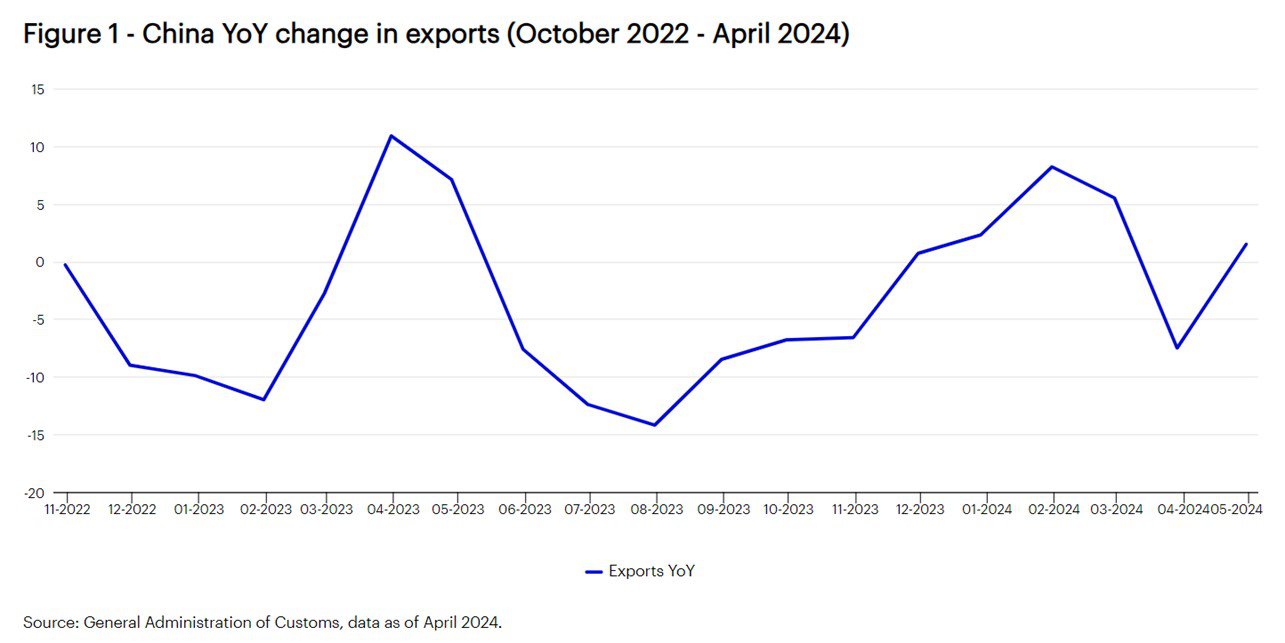

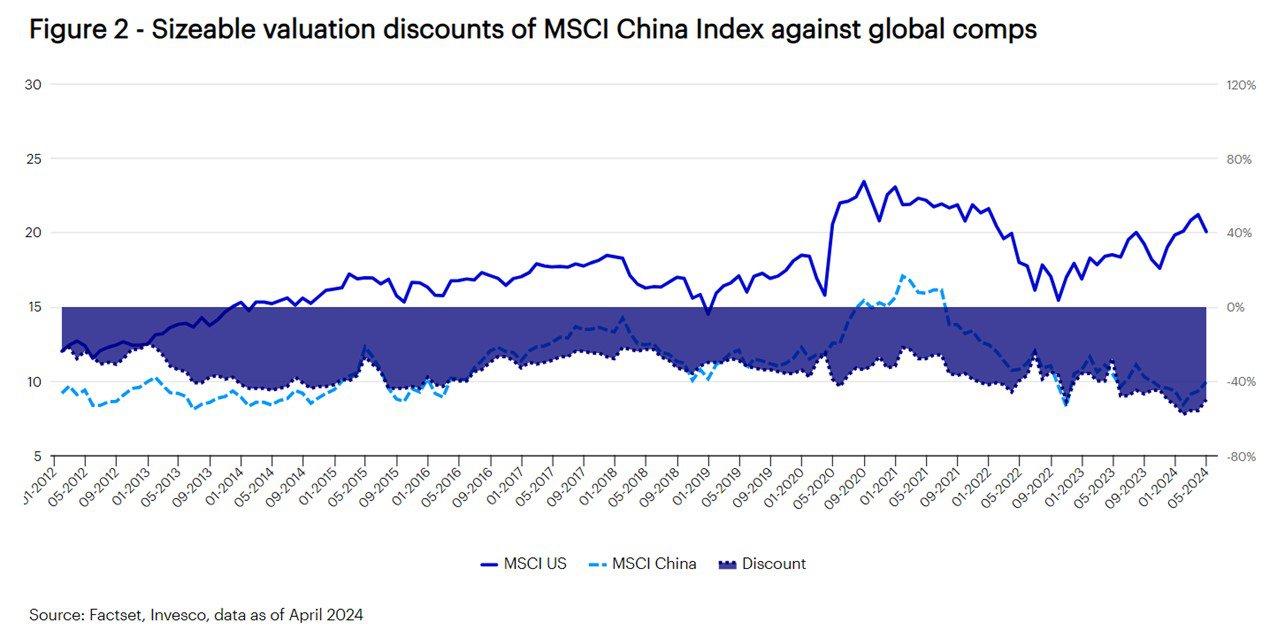

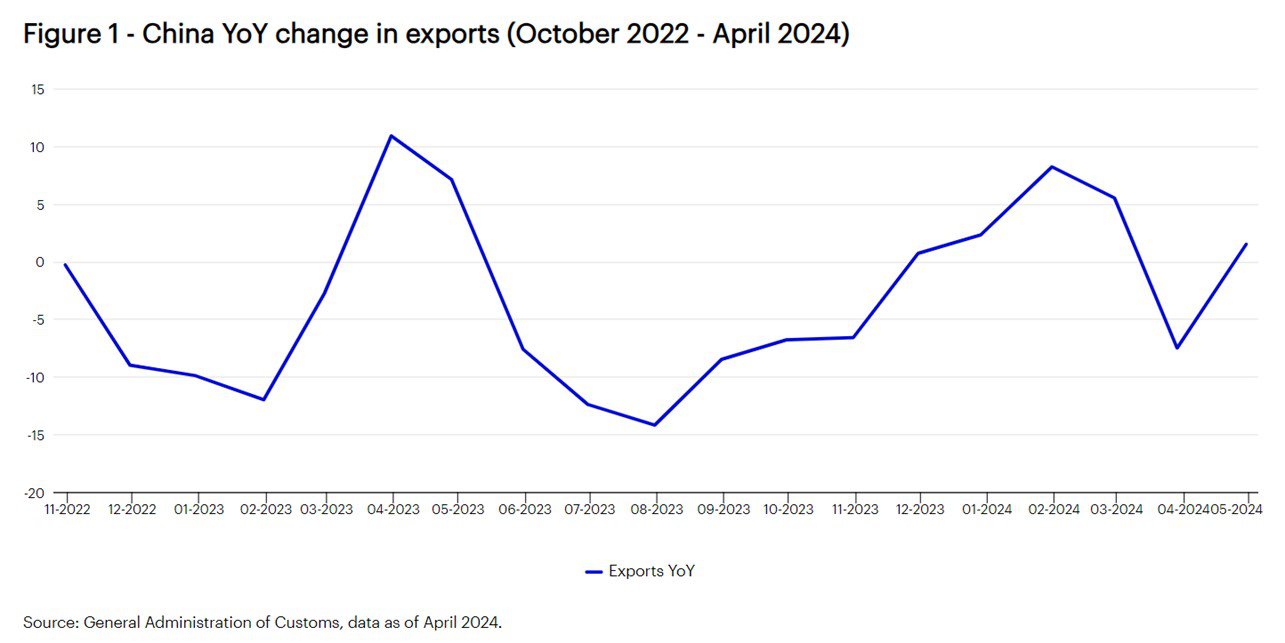

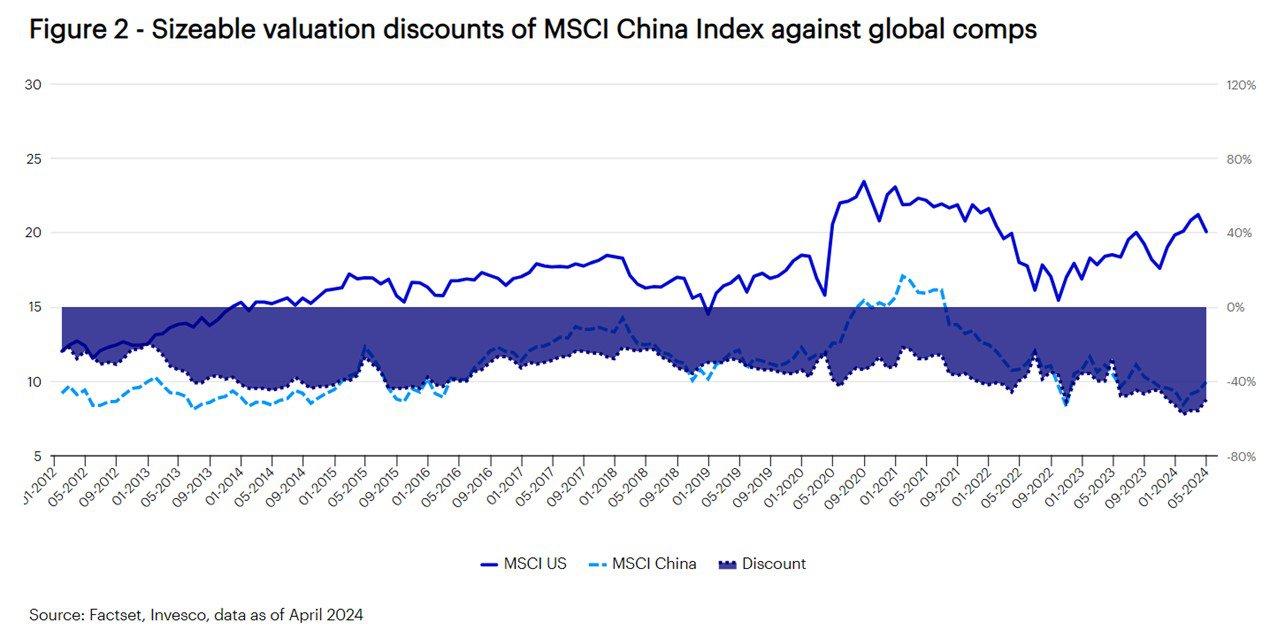

China’s equity market has seen positive momentum so far this year, rebounding by over 30% since the trough in January. Both onshore and offshore Chinese equities have recorded positive returns year-to-date, with materials, industrials, and communication services sectors in positive territory.China’s economy has also shown resilience. The country’s GDP grew by 5.3% year-over-year in Q11, surpassing market expectations. We expect the recovery to continue through to Q2 and are seeing ongoing signs of this from economic data and travel indicators. Industrial production has had robust growth year-to-date, and exports have returned to positive territory. The positive factors that drove economic stabilization and upward momentum in the first half of 2024 are expected to continue into the second half.China's economic recoveryLooking ahead, we anticipate a continued recovery in China's exports and domestic demand over the second half of the year. On the manufacturing side, there was a positive year-on-year change in exports in the first quarter of 2024, reflecting the increased business activity and production momentum of Chinese companies. Exports to ASEAN, Latin America, and Africa have risen, suggesting that Chinese companies have been expanding their global market reach. We believe the increase in exports marks an encouraging improvement in both domestic and overseas demand. In terms of consumption, key indicators are moving in the right direction, including retail sales, travel data, and automotive sector performance. Consumer confidence is also rising and retail sales in China have had a close to 5% year-on-year increase2. The e-commerce sector in particular has expanded rapidly. We expect this consumption momentum to continue for the rest of the year. After China’s reopening, we’ve seen robust holiday and travel spending data, including a 13.5% year-on-year increase in tourism revenue3 during the recent Labor Day holiday, compared to pre-pandemic levels. Looking ahead, we expect a steady increase in consumption for the upcoming holiday season.The government’s monetary policy stance has been supportive, and we expect further cuts to the reserve requirement ratio (RRR), as well as interest rate cuts to accommodate faster government bond issuance. We believe these measures will provide additional stimulus to help revitalize China’s economy.Potential investment opportunitiesGoing forward, we see ample investment opportunities in China equities centered around the themes of reorganization of the global supply chain and the electrification and energy revolution. We continue to expect these trends to benefit Chinese companies in 2H 2024.Chinese corporates are poised to benefit significantly by expanding their supply chain and global footprint. In doing so companies can benefit from sustained local demand in overseas markets to capture a larger share of the worldwide customer base. Chinese firms currently enjoy a cost advantage stemming from their large domestic market and economies of scale. We anticipate that these companies will have stronger earnings growth and overall growth prospects in the years ahead. We believe China’s ongoing efforts to strengthen its global market presence will unlock opportunities for investors to engage in the country’s expanding international trade and investment landscape.Chinese companies are also benefitting from the global transition towards clean energy and are likely to play a key role in electrification and energy transformation trends. This is due to their strong presence across the entire green supply chain as well as the cost efficiencies gained from their large domestic market base. An example of one such opportunity lies in a tap changer manufacturer with ongoing overseas expansion plans that aims to build a full-scale industry supply chain. Currently, there are two major tap changer manufacturers globally that account for a large proportion of the overall market share. One is a privately-owned German company, and the other is the Chinese manufacturer. As tap changers are a crucial component in transformers that are seeing rising demand, investing in these companies could allow investors to capitalize on the anticipated surge in interest. We expect companies like this to emerge as key beneficiaries of the power grid upgrade trend.Despite challenges, more clarity lies aheadWe believe investors considering China should also be mindful about potential challenges. The property sector set back in the past few years has put pressure on economic growth. We are seeing policies being put forward to stabilize the property market on a gradual basis and need to wait for some time before we see the impact of these measures. Such policies include guaranteeing the delivery of pre-sold homes, cutting mortgage rates, and enacting minimum downpayment requirements. We anticipate further policy stimulus for the property sector going forward. In terms of the external macro environment, with the highly anticipated US presidential election approaching before the year's end, we believe the market can expect more headline news that could result in short-term volatility.China equities are trading at attractive valuationsAt present, China's equity market valuations are trading at relatively low levels both in historical terms and compared to developed markets. In fact, the MSCI China Index is currently trading at a significant discount of around 50% relative to the MSCI US Index. We believe this presents an attractive opportunity for investors to potentially capitalize on.

In terms of consumption, key indicators are moving in the right direction, including retail sales, travel data, and automotive sector performance. Consumer confidence is also rising and retail sales in China have had a close to 5% year-on-year increase2. The e-commerce sector in particular has expanded rapidly. We expect this consumption momentum to continue for the rest of the year. After China’s reopening, we’ve seen robust holiday and travel spending data, including a 13.5% year-on-year increase in tourism revenue3 during the recent Labor Day holiday, compared to pre-pandemic levels. Looking ahead, we expect a steady increase in consumption for the upcoming holiday season.The government’s monetary policy stance has been supportive, and we expect further cuts to the reserve requirement ratio (RRR), as well as interest rate cuts to accommodate faster government bond issuance. We believe these measures will provide additional stimulus to help revitalize China’s economy.Potential investment opportunitiesGoing forward, we see ample investment opportunities in China equities centered around the themes of reorganization of the global supply chain and the electrification and energy revolution. We continue to expect these trends to benefit Chinese companies in 2H 2024.Chinese corporates are poised to benefit significantly by expanding their supply chain and global footprint. In doing so companies can benefit from sustained local demand in overseas markets to capture a larger share of the worldwide customer base. Chinese firms currently enjoy a cost advantage stemming from their large domestic market and economies of scale. We anticipate that these companies will have stronger earnings growth and overall growth prospects in the years ahead. We believe China’s ongoing efforts to strengthen its global market presence will unlock opportunities for investors to engage in the country’s expanding international trade and investment landscape.Chinese companies are also benefitting from the global transition towards clean energy and are likely to play a key role in electrification and energy transformation trends. This is due to their strong presence across the entire green supply chain as well as the cost efficiencies gained from their large domestic market base. An example of one such opportunity lies in a tap changer manufacturer with ongoing overseas expansion plans that aims to build a full-scale industry supply chain. Currently, there are two major tap changer manufacturers globally that account for a large proportion of the overall market share. One is a privately-owned German company, and the other is the Chinese manufacturer. As tap changers are a crucial component in transformers that are seeing rising demand, investing in these companies could allow investors to capitalize on the anticipated surge in interest. We expect companies like this to emerge as key beneficiaries of the power grid upgrade trend.Despite challenges, more clarity lies aheadWe believe investors considering China should also be mindful about potential challenges. The property sector set back in the past few years has put pressure on economic growth. We are seeing policies being put forward to stabilize the property market on a gradual basis and need to wait for some time before we see the impact of these measures. Such policies include guaranteeing the delivery of pre-sold homes, cutting mortgage rates, and enacting minimum downpayment requirements. We anticipate further policy stimulus for the property sector going forward. In terms of the external macro environment, with the highly anticipated US presidential election approaching before the year's end, we believe the market can expect more headline news that could result in short-term volatility.China equities are trading at attractive valuationsAt present, China's equity market valuations are trading at relatively low levels both in historical terms and compared to developed markets. In fact, the MSCI China Index is currently trading at a significant discount of around 50% relative to the MSCI US Index. We believe this presents an attractive opportunity for investors to potentially capitalize on. Want to search and invest in related funds?Open the WeLab Bank App and click【Featured Funds > Equity > China Equity】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Note:

Want to search and invest in related funds?Open the WeLab Bank App and click【Featured Funds > Equity > China Equity】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Note:- Goldman Sachs Global Investment Research, April 2024

- Retail sales jump 4.7% year-on-year in Q1, showing a stable consumption expansion, Global Times, April 2024, https://www.globaltimes.cn/page/202404/1310676.shtml

- China May Day holiday spending shows mixed picture on post-COVID recovery, Reuters, May 2024, https://www.reuters.com/world/china/china-may-day-holiday-spending-delivers-mixed-picture-post-covid-recovery-2024-05-06/

Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.  In terms of consumption, key indicators are moving in the right direction, including retail sales, travel data, and automotive sector performance. Consumer confidence is also rising and retail sales in China have had a close to 5% year-on-year increase2. The e-commerce sector in particular has expanded rapidly. We expect this consumption momentum to continue for the rest of the year. After China’s reopening, we’ve seen robust holiday and travel spending data, including a 13.5% year-on-year increase in tourism revenue3 during the recent Labor Day holiday, compared to pre-pandemic levels. Looking ahead, we expect a steady increase in consumption for the upcoming holiday season.The government’s monetary policy stance has been supportive, and we expect further cuts to the reserve requirement ratio (RRR), as well as interest rate cuts to accommodate faster government bond issuance. We believe these measures will provide additional stimulus to help revitalize China’s economy.Potential investment opportunitiesGoing forward, we see ample investment opportunities in China equities centered around the themes of reorganization of the global supply chain and the electrification and energy revolution. We continue to expect these trends to benefit Chinese companies in 2H 2024.Chinese corporates are poised to benefit significantly by expanding their supply chain and global footprint. In doing so companies can benefit from sustained local demand in overseas markets to capture a larger share of the worldwide customer base. Chinese firms currently enjoy a cost advantage stemming from their large domestic market and economies of scale. We anticipate that these companies will have stronger earnings growth and overall growth prospects in the years ahead. We believe China’s ongoing efforts to strengthen its global market presence will unlock opportunities for investors to engage in the country’s expanding international trade and investment landscape.Chinese companies are also benefitting from the global transition towards clean energy and are likely to play a key role in electrification and energy transformation trends. This is due to their strong presence across the entire green supply chain as well as the cost efficiencies gained from their large domestic market base. An example of one such opportunity lies in a tap changer manufacturer with ongoing overseas expansion plans that aims to build a full-scale industry supply chain. Currently, there are two major tap changer manufacturers globally that account for a large proportion of the overall market share. One is a privately-owned German company, and the other is the Chinese manufacturer. As tap changers are a crucial component in transformers that are seeing rising demand, investing in these companies could allow investors to capitalize on the anticipated surge in interest. We expect companies like this to emerge as key beneficiaries of the power grid upgrade trend.Despite challenges, more clarity lies aheadWe believe investors considering China should also be mindful about potential challenges. The property sector set back in the past few years has put pressure on economic growth. We are seeing policies being put forward to stabilize the property market on a gradual basis and need to wait for some time before we see the impact of these measures. Such policies include guaranteeing the delivery of pre-sold homes, cutting mortgage rates, and enacting minimum downpayment requirements. We anticipate further policy stimulus for the property sector going forward. In terms of the external macro environment, with the highly anticipated US presidential election approaching before the year's end, we believe the market can expect more headline news that could result in short-term volatility.China equities are trading at attractive valuationsAt present, China's equity market valuations are trading at relatively low levels both in historical terms and compared to developed markets. In fact, the MSCI China Index is currently trading at a significant discount of around 50% relative to the MSCI US Index. We believe this presents an attractive opportunity for investors to potentially capitalize on.

In terms of consumption, key indicators are moving in the right direction, including retail sales, travel data, and automotive sector performance. Consumer confidence is also rising and retail sales in China have had a close to 5% year-on-year increase2. The e-commerce sector in particular has expanded rapidly. We expect this consumption momentum to continue for the rest of the year. After China’s reopening, we’ve seen robust holiday and travel spending data, including a 13.5% year-on-year increase in tourism revenue3 during the recent Labor Day holiday, compared to pre-pandemic levels. Looking ahead, we expect a steady increase in consumption for the upcoming holiday season.The government’s monetary policy stance has been supportive, and we expect further cuts to the reserve requirement ratio (RRR), as well as interest rate cuts to accommodate faster government bond issuance. We believe these measures will provide additional stimulus to help revitalize China’s economy.Potential investment opportunitiesGoing forward, we see ample investment opportunities in China equities centered around the themes of reorganization of the global supply chain and the electrification and energy revolution. We continue to expect these trends to benefit Chinese companies in 2H 2024.Chinese corporates are poised to benefit significantly by expanding their supply chain and global footprint. In doing so companies can benefit from sustained local demand in overseas markets to capture a larger share of the worldwide customer base. Chinese firms currently enjoy a cost advantage stemming from their large domestic market and economies of scale. We anticipate that these companies will have stronger earnings growth and overall growth prospects in the years ahead. We believe China’s ongoing efforts to strengthen its global market presence will unlock opportunities for investors to engage in the country’s expanding international trade and investment landscape.Chinese companies are also benefitting from the global transition towards clean energy and are likely to play a key role in electrification and energy transformation trends. This is due to their strong presence across the entire green supply chain as well as the cost efficiencies gained from their large domestic market base. An example of one such opportunity lies in a tap changer manufacturer with ongoing overseas expansion plans that aims to build a full-scale industry supply chain. Currently, there are two major tap changer manufacturers globally that account for a large proportion of the overall market share. One is a privately-owned German company, and the other is the Chinese manufacturer. As tap changers are a crucial component in transformers that are seeing rising demand, investing in these companies could allow investors to capitalize on the anticipated surge in interest. We expect companies like this to emerge as key beneficiaries of the power grid upgrade trend.Despite challenges, more clarity lies aheadWe believe investors considering China should also be mindful about potential challenges. The property sector set back in the past few years has put pressure on economic growth. We are seeing policies being put forward to stabilize the property market on a gradual basis and need to wait for some time before we see the impact of these measures. Such policies include guaranteeing the delivery of pre-sold homes, cutting mortgage rates, and enacting minimum downpayment requirements. We anticipate further policy stimulus for the property sector going forward. In terms of the external macro environment, with the highly anticipated US presidential election approaching before the year's end, we believe the market can expect more headline news that could result in short-term volatility.China equities are trading at attractive valuationsAt present, China's equity market valuations are trading at relatively low levels both in historical terms and compared to developed markets. In fact, the MSCI China Index is currently trading at a significant discount of around 50% relative to the MSCI US Index. We believe this presents an attractive opportunity for investors to potentially capitalize on. Want to search and invest in related funds?Open the WeLab Bank App and click【Featured Funds > Equity > China Equity】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Note:

Want to search and invest in related funds?Open the WeLab Bank App and click【Featured Funds > Equity > China Equity】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Note: